Please note that due to National Day holidays, applications received after 4pm, 08 August 2024, will only be processed and transmitted to Ministry of Manpower (MOM) on 12 August 2024. Policies with start date on 13 and 14 August 2024 may be affected

Why Tiq Maid Insurance?

Protect your maid with the right coverage while safeguarding against unexpected expenses and liabilities as an employer

We have enhanced our plans in compliance with the Ministry of Manpower’s (MOM) Enhanced Medical Insurance for Foreign Employees. Find out more here.

Personal accident cover for your maid from S$60,000

Hospitalisation & Surgical expenses for your maid, with COVID-19 and Infectious Disease coverage Enhanced

Repatriation expenses of S$10,000

Wages compensation & levy reimbursement

Medical expenses reimbursement in case of abuse by maid

Waiver of co-insurance under Hospitalisation & Surgical expenses add-on New

- Security bond to Ministry of Manpower that limits your liability from S$5,000 to S$250 with Security Bond Protector Popular

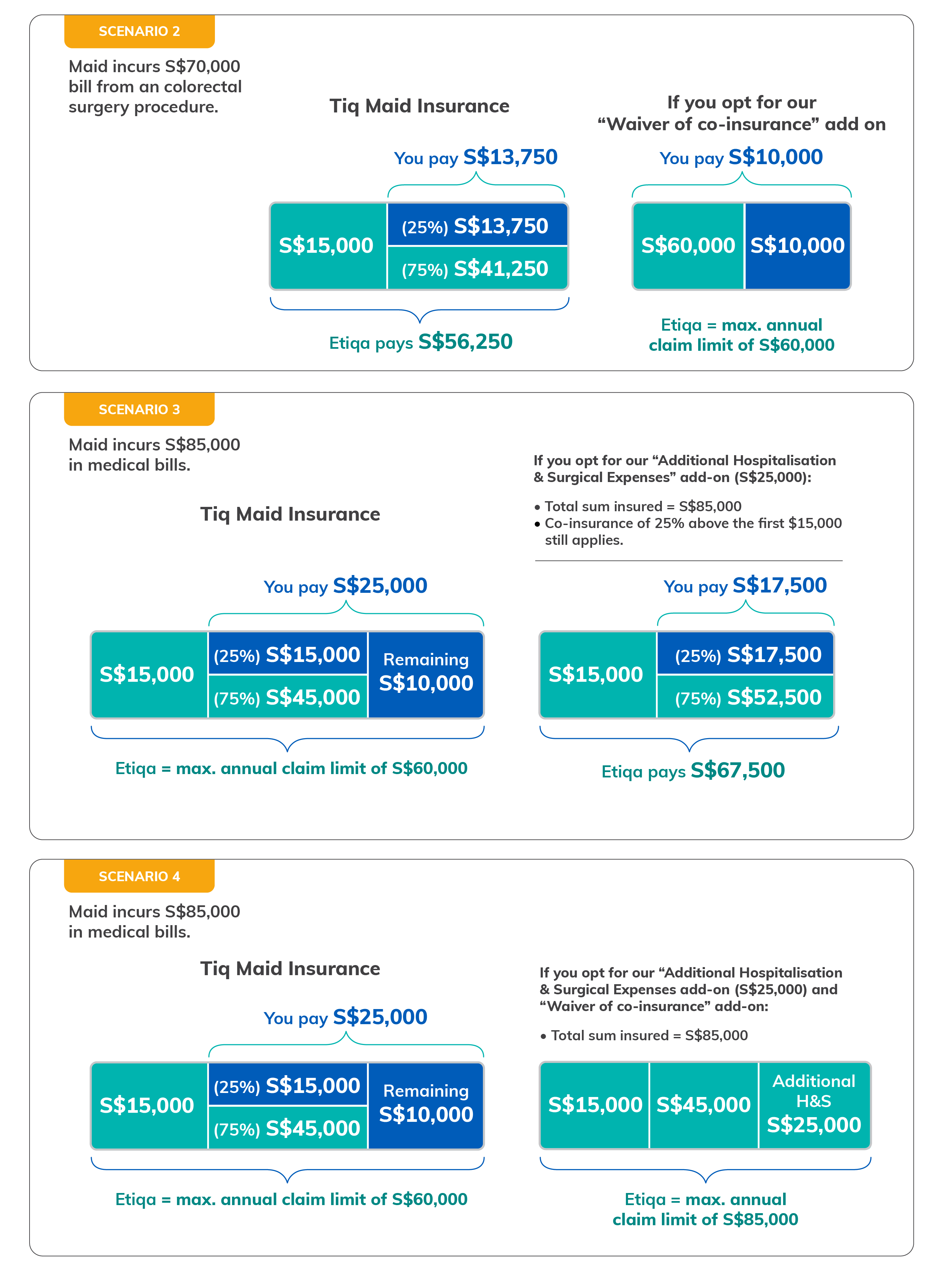

- Top-up Hospitalisation and Surgical Expenses coverage for your maid up to S$25,000

- Critical Illness coverage for your maid from S$5,000

- Home cover due to fire, burglary or theft by maid

- Additional Third Party Liability coverage in the event that your maid causes accidental bodily injury and/or accidental damage to a third party

- Waiver of co-insurance under Hospitalisation & Surgical expenses (co-insurance of 25% for the amount above the first $15,000 will be waived) New

Flexible coverage for you & your maid

| BENEFITS | PLAN A | PLAN B | PLAN C |

|---|---|---|---|

| Sum insured(S$) | |||

| Letter of Guarantee to the Ministry of Manpower Singapore (Security Bond) | $5,000 | $5,000 | $5,000 |

| Repatriation Expenses | $10,000 | $10,000 | $10,000 |

| Wages & Levy Reimbursement (max. 30 days of Hospitalisation) | Up to $30 per day | Up to $30 per day | Up to $30 per day |

| Alternative Maid Services (max. 30 days of Hospitalisation) | Up to $10 per day | Up to $15 per day | Up to $20 per day |

| Termination/ Re-Hiring Expenses | $250 | $300 | $350 |

| Special Grant | $500 | $1,000 | $2,000 |

| Medical expenses reimbursement in the event of abuse by maid | Up to $5,000 | Up to $5,000 | Up to $5,000 |

| BENEFITS | PLAN A | PLAN B | PLAN C |

|---|---|---|---|

| Sum insured(S$) | |||

| Personal Accident Benefits | |||

| Accidental Death | $60,000 | $65,000 | $70,000 |

| Permanent Disablement | |||

| Medical Expenses due to Accident or Injury | $1,000 | $2,000 | $3,000 |

| Recuperation Benefits (max. 30 days of Hospitalisation) |

Up to $10 per day | Up to $15 per day | Up to $20 per day |

| Hospitalisation & Surgical Expenses (annual limit for in-patient expenses including Day Surgery) This Section is extended to cover COVID-19 and Infectious Diseases |

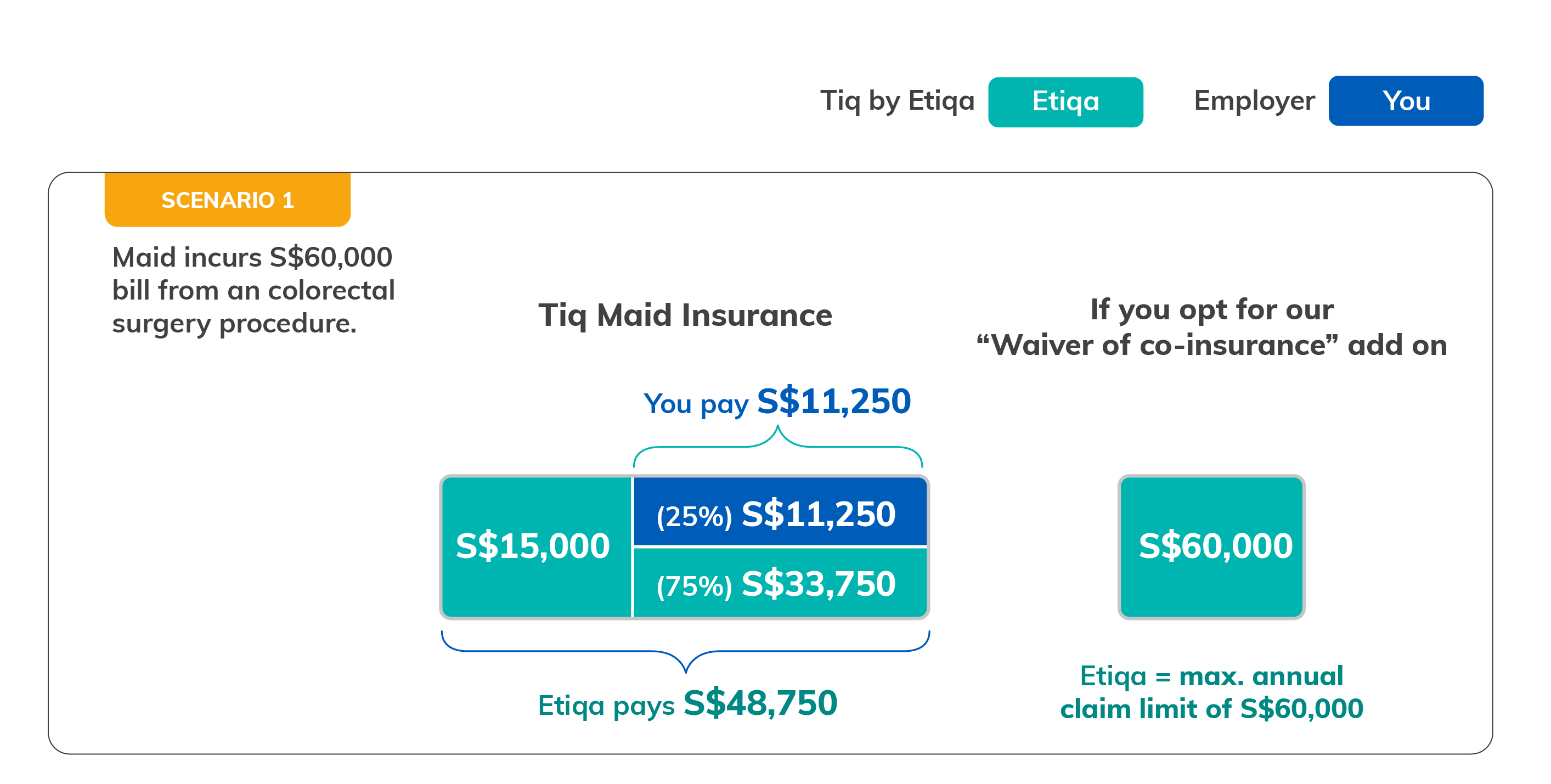

$60,000 per year Co-insurance of 25% for the amount about the first S$15,000 applies |

$60,000 per year Co-insurance of 25% for the amount about the first S$15,000 applies |

$60,000 per year Co-insurance of 25% for the amount about the first S$15,000 applies |

| Third Party Liability | $5,000 | $7,500 | $10,000 |

*Refer to illustration below for co-insurance between employer (“You”) and Tiq by Etiqa (“Etiqa”)

| BENEFITS | Sum insured(S$) |

| Security Bond Protector Popular | $5,000 (excess of $250) |

| Additional Hospitalisation & Surgical Expenses Popular | Top-up sum of $5,000 to $25,000 |

| Critical Illness Cover | Choice of $5,000/$10,000/$20,000 |

| Home Cover (valuables are capped at 10% of sum insured) | Option of up to $5,000/$10,000/$20,000 |

| Additional Third Party Liability | Option of $25,000/$50,000/$75,000 |

| Waiver of co-insurance under Hospitalisation & Surgical Expenses New | Co-insurance of 25% for the amount above the first S$15,000 will be waived under Hospitalisation & Surgical Expenses. |

| PLAN | Premium (S$) after 34% off discount and prevailing GST |

| 26 months | |

|---|---|

| Plan A | $490.63 |

| Plan B | $530.19 |

| Plan C | $591.35 |

| 14 months | |

| Plan A | $353.22 |

| Plan B | $382 |

| Plan C | $425.89 |

| PLAN | Premium (S$) after 34% off discount and prevailing GST | |

| 26 months | ||

|---|---|---|

| Security Bond Protector PopularThis option limits your liability to $250 if the breach of the Security Bond is not due to your negligence/fault. | $46.76 | |

| Additional Hospitalisation & Surgical Expenses Boost your maid's coverage with this add-on. | From $30.21 | |

| Critical Illness Cover Receive a lump sum benefit if your maid is diagnosed with any of the 20 Critical Illnesses covered (e.g. Major Cancer, Stroke, or Heart Attack of Specified Severity). | From $13.93 | |

| Home Cover Coverage for your home contents due to fire, burglary or theft by maid (Valuables capped to 10% of Sum Insured). | From $9.08 | |

| Additional Third Party Liability Increase coverage in the event that your maid causes accidental bodily injury (whether fatal or not) and/or accidental damage to a third party. | From $33.62 | |

| Waiver of co-insurance under Hospitalisation & Surgical Expenses | $99.28 | |

| 14 months | ||

| Security Bond Protector Popular | $46.76 | |

| Additional Hospitalisation & Surgical Expenses | From $21.58 | |

| Critical Illness Cover | From $7.53 | |

| Home Cover | From $6.39 | |

| Additional Third Party Liability | From $23.53 | |

| Waiver of co-insurance under Hospitalisation & Surgical Expenses | $71.22 | |

Have questions? We’re here to help

Protecting your sanctuary should be exciting, not stressful. Let us guide you.

Our operating hours are: Monday to Friday, 9.00am to 5.30pm (excluding public holidays)

Frequently Asked Questions

As the effective start date of your maid insurance is on or after 1 July 2023, you will need to comply with Ministry of Manpower’s (MOM) Enhanced Medical Insurance for Foreign Employees requirements and upgrade your plan to meet the medical insurance limit of S$60,000.

You can contact our friendly Customer Care consultants for them to facilitate the change:

- WhatsApp us at our hotline, +65 6887 8777, Monday to Friday, 8.45am to 5.30pm (excluding Public Holidays), or

- Email us via customer.service@etiqa.com.sg

The applicant must be at least 21 years of age, and the maid must be at least 23 years of age on the start date of the policy.

If you have a TiqConnect account with Etiqa, please log onto TiqConnect to submit your claims online. Otherwise, you may register for an account on our corporate website. Access can be created immediately. You may also contact our Customer Care hotline at +65 6887 8777 or email them at customer.service@etiqa.com.sg for further assistance.

Information You Might Find Useful

Featured Articles

Step-by-Step Guide for Maid Transfer

How Much Should I Pay My Maid?

The Cost of Hiring a Maid in Singapore

Important notes:

This policy is underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you.

For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is accurate as at 29 March 2024.

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.